Every employee paycheck is based on hours worked within a pay period. A set schedule that repeats itself over and over and determined by the employer.

It all depends on how often the employer chooses to pay their employees. For example, once a week, every two weeks, twice a month, or once a month. Sometimes pay periods are even longer, however rare.

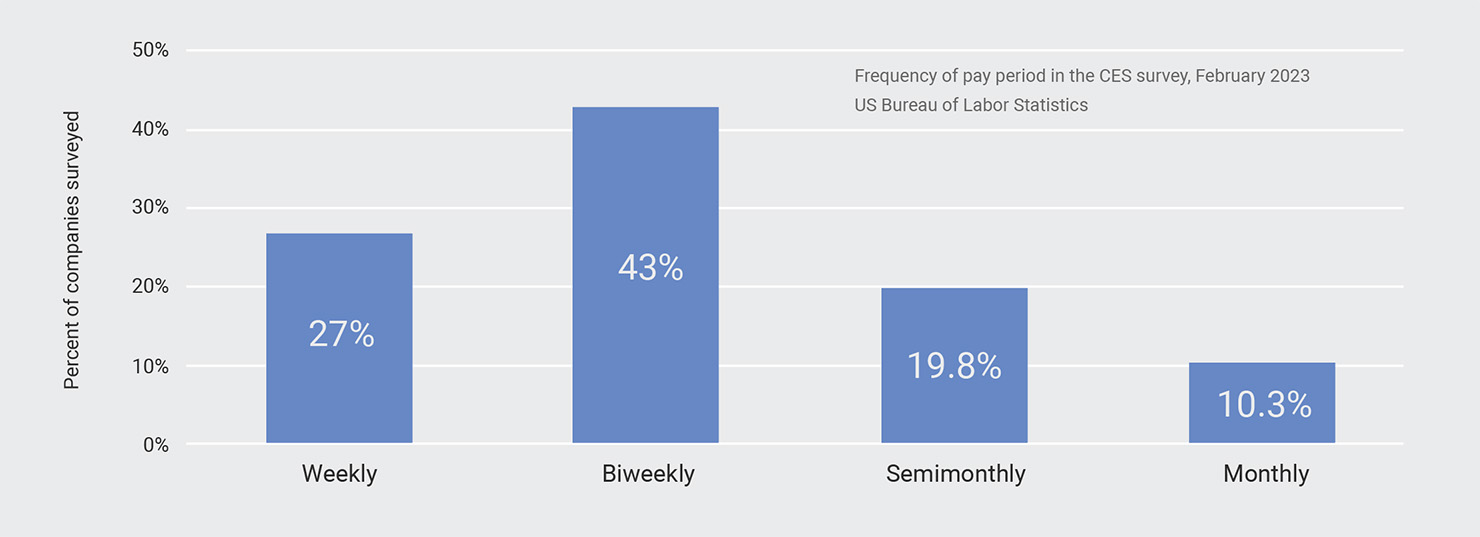

The chart above is from a 2023 U.S. Bureau of Labor Statistics survey. It shows that the majority of companies surveyed use Biweekly as their pay period. So... is that the best pay period for your payroll? Maybe, but read further to know for sure.

The exception to a pay period is known as off-cycle payroll. This can happen if someone receives a paycheck to compensate for a mistake, receives a bonus, or was let go early. But for this article, we'll focus only on regular payroll. Here is what we'll cover.

- The four most common pay periods

- Pay period usage by industry

- State payday requirements

- Other considerations

- Conclusion

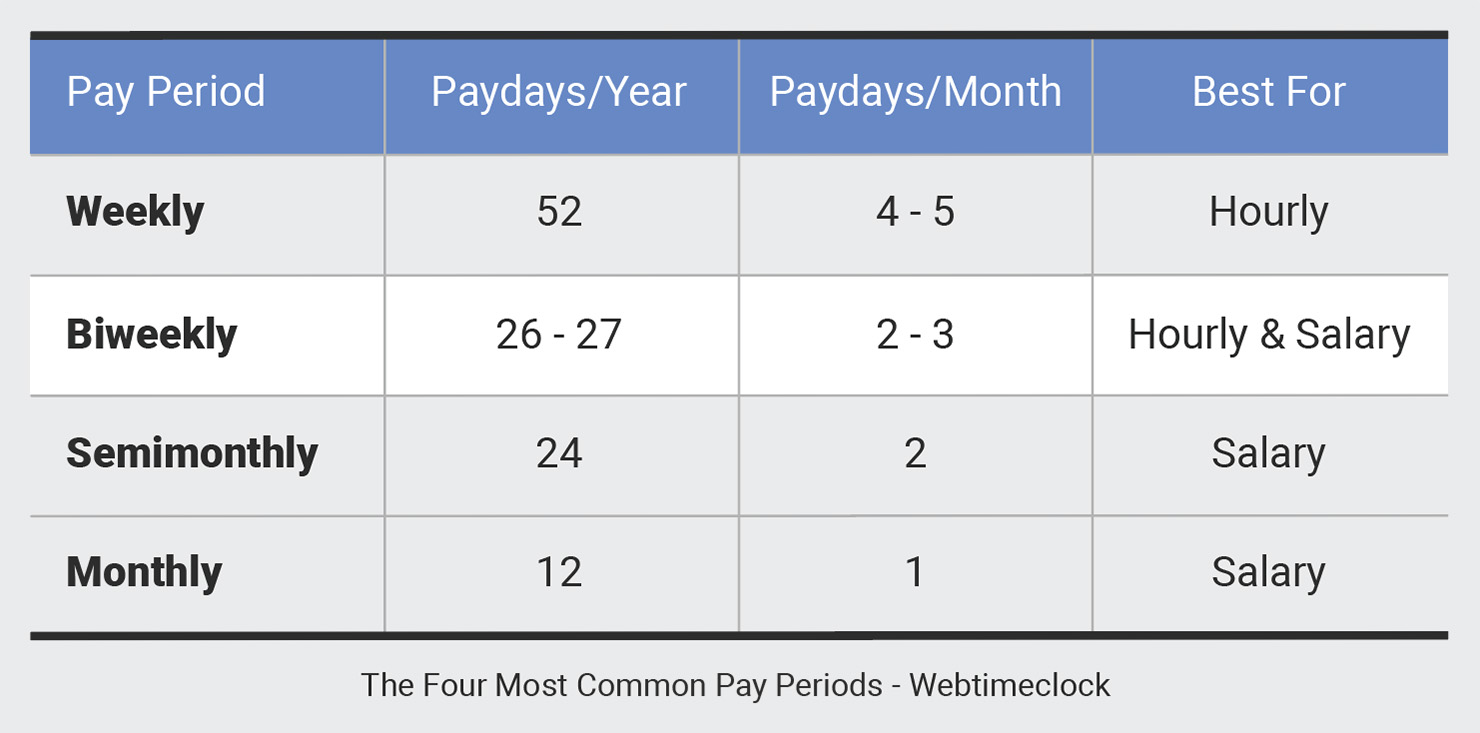

The four most common pay periods

Weekly

Weekly pays once a week, typically on Friday. It requires the most payroll runs, but benefits hourly employees who often live paycheck to paycheck.

Biweekly

Biweekly pays every other week, typically every other Friday. This is the most popular of all pay periods as it benefits both hourly and salary employees. Normally there are 26 paydays in a year, but it is possible to have 27.

Semimonthly

Semimonthly pays twice a month, typically on the 1st and 15th of the month, or the 15th and last day of the month. Best used with mostly salary employees as calculating weekly overtime for hourly employees can be complicated. Also, semimonthly paydays could conflict with bank holidays.

Monthly

Monthly pays once a month, typically on the 15th, the least popular of common pay periods. Best used only for salary employees, as most workers prefer to be paid more often. Monthly paydays could conflict with bank holidays.

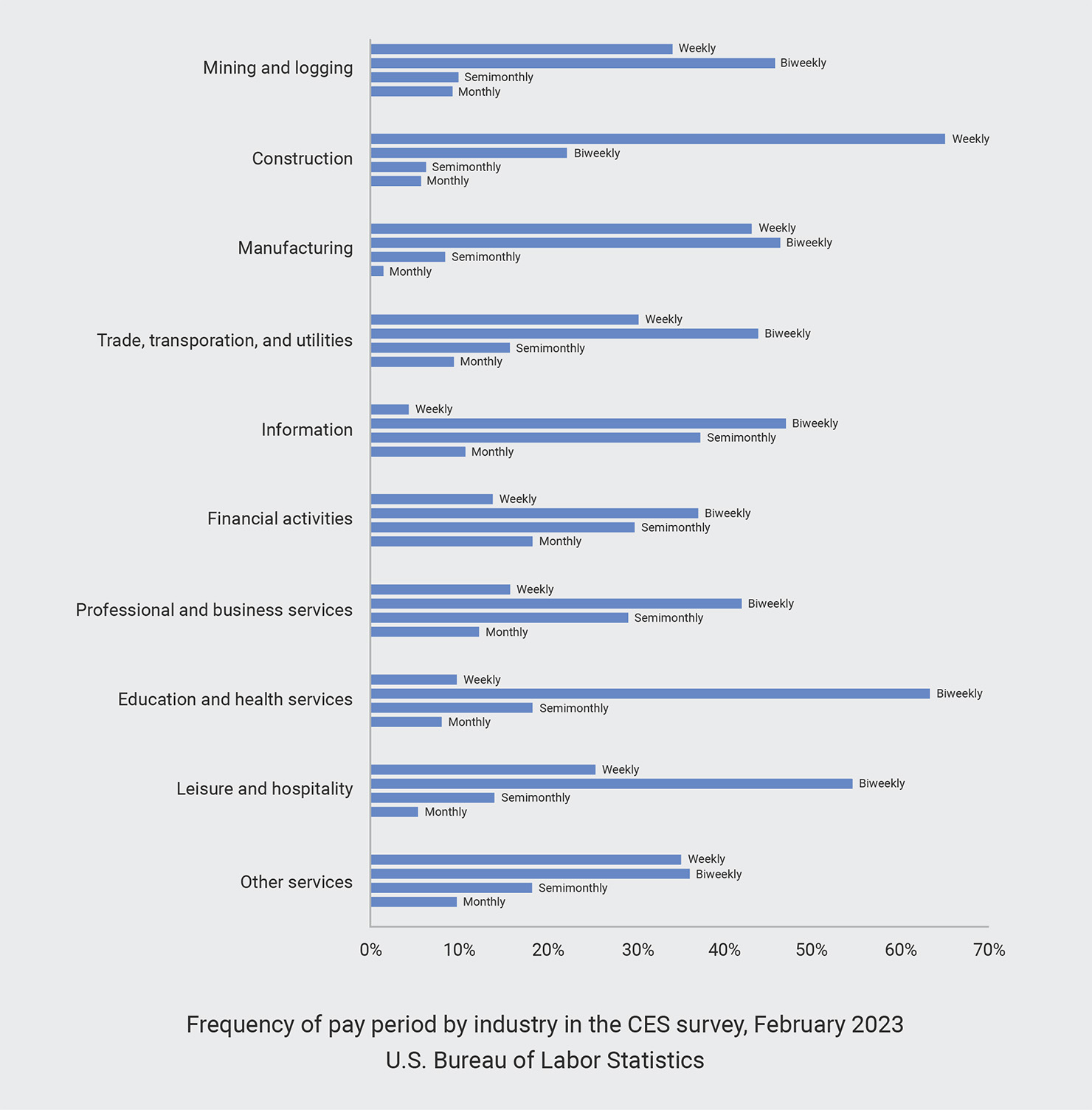

Pay period usage by industry

Construction and manufacturing have the highest usage of Weekly pay periods, maybe as a reflection of their hourly workforce. For all other industries, Biweekly is the preferred pay period for payroll.

State payday requirements

When choosing a pay period make sure it's compliant with your state. Most states require paydays at least once a month, but others are more often. Here is a list of State Payday Requirements published by the U.S. Department of Labor.

Other considerations

Outside of what others do, there are three important factors in deciding on a pay period.

First is your workforce. Do you have mostly hourly workers, or mostly salary workers? Or do you have an even split between the two? As a group, what would they prefer? Would it make sense to have two pay periods instead of just one depending on that workforce?

Second is your cash flow. Does your cash runway allow you to run payroll more frequently or less frequently? And does this fit with the needs of your employees?

Third are your payroll costs. For outsourced payroll, some providers charge per payroll run, while others, such as Webtimeclock, only charge once per month. If you run payroll in house, will more frequent payroll runs cost you more? And could frequent payroll runs lead to mistakes?

These are all questions only you can answer.

Conclusion

The best pay period for payroll is what is best for your company... as long as it's compliant. Most companies use Biweekly as it accommodates both hourly and salary workers, works well with weekly overtime, and does not typically conflict with bank holidays. Biweekly is what we always recommend, however it may not always be the best fit for your company.

Grab our RSS Feed

Webtimeclock is an online time clock plus optional online payroll. Have questions? Contact our support team, or call us at 1-800-450-2692. Sign up today for your free 15-day trail. We are located in San Diego (Carlsbad), CA USA.